Frequently Asked Questions

When a person dies and leaves a savings account, home, and other property titled in his/her name, it usually requires a court order to change the title of a property. So, even if you do have a Will, your family Will have to request probate through the courts to get a court order to change the title.

It is against the law to remove any property from the decedent’s home until the probate proceedings are complete. If you risk removing anything from the decedent’s home, you could face serious charges. Don’t do it or let anyone else do it.

Once one of the family members or executor requests probate, a formal written petition must be filed. This is usually prepared by an attorney.

The next step the executor takes is to advertise a formal notice of your death in the newspapers. This is usually ordered by the court and paid for through your estate. This is done to notify any creditors or anyone else making a claim against your estate. During this time, usually several weeks, your executor notifies all of the heirs of your death and the time, date, and place of the probate proceeding.

Approximately two months have passed since the first petition was filed. If there are no unusual circumstances, the next step is usually the first hearing.

The first hearing

At this hearing, the judge Will make sure there are no other conflicting Wills, validate your Will, and make sure your Will meets all the legal requirements. If it does not, the judge may declare that you died intestate (without a Will) and apply the state's rules for a Will. The judge Will formally appoint an executor (the person you chose if you had a Will), administrator, or manager to perform these duties.

Some of the executor’s responsibilities include collecting all bills, helping the court inventory all property, preparing a final tax return, and submitting all bills to the court to be approved and paid. The executor Will also contact organizations such as unions and other groups for any death benefit that may be due. The banks require a written document from the court to release funds or close any accounts. This legal document is called a “letter of testamentary” or “letter of administration.” It gives the executor the right to your assets and to keep them safe until the probate hearing is complete.

In many states, the executors are not allowed to act independently and must get approval from the court for all actions. More recently, some states have adopted a policy of unsupervised independent administration. This is where the executor’s actions are not closely audited by the court. The probate process is still very slow and requires a lot of paperwork. There may be different requirements in each state which allow independent administration.

If there are any unusual circumstances such as a contested Will, or unknown or contesting heirs, the court Will try to resolve them at this hearing. In the event they are not resolved, there may be other hearings; this can get quite expensive. At the end of the first hearing, an attorney is usually appointed to handle the estate’s paperwork. This paperwork can get quite complicated and is best done by an attorney who is familiar with the probate system. The attorney fees get paid through the estate.

All your assets are frozen during probate until an accurate inventory is taken. This means that no property can be sold unless the court gives its’ permission. Your executor must now compile an inventory of all your assets. This can be very time-consuming, especially if there are assets such as real estate in other states. The executor must prove the value of some of the assets via appraisals by court-approved appraisers. This too can get very expensive.

Your attorney can submit a request for a living allowance for your spouse, minor children, or grandparents. In most cases, if it is reasonable and there no special circumstances are pending, the judge may allow it.

After the newspaper notice of your death, your creditors have a certain number of days to submit a claim for payment. Your executor Will compile a list of claims and any taxes that are due and submit them to the court for approval. Once the judge has approved them, they can be paid through your estate’s assets. If there are any disputes the judge Will have the final decision.

By now, a year or more has passed and your estate is getting closer to the final distribution and the closing of the estate. The judge Will order another notice in a different publication, advertising the final hearing of your estate. He Will review all claims, taxes, and probate expenses including attorney fees, executor fees, appraisals, and other costs. In some states, this step may not be necessary.

Once the judge is satisfied that all the paperwork is in order, he Will authorize that final distribution to be paid. If there is not enough money in the estate, the judge Will now require some of the assets to be sold at auction. Your assets are usually sold at less than they are worth, especially during a depressed market. Often, with many assets such as stocks, bonds, and real estate, if you can’t sell them at the right time or act quickly, you stand to lose a considerable amount of money.

The word probate comes from the Latin root, “probs,” which means “to probe.” Probate is a process that the courts use to transfer title to the property and make sure your debts are paid after you die. It is usually associated with the distribution of property through your Will.

When an estate is probated, property of value is usually transferred to the new owners. Probate is not automatic; it must be requested by an individual or family member. If you become physically or mentally disabled and you inherit property, a process similar to probate can occur while you are alive. This process is called Conservatorship and it allows the court to take control of all proceeds.

In short, probate is a legal procedure used by the courts to transfer the title of the property. This can include real estate, automobiles, stocks and bonds, money, etc.

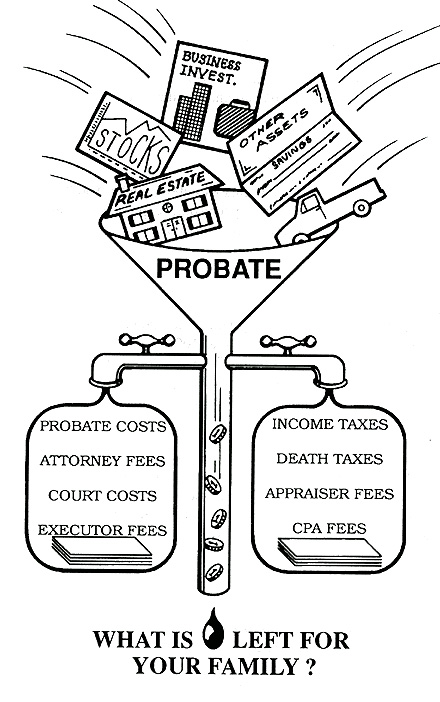

You can be the judge. Estimates of probate costs range from 5% to 10% of the gross value of an estate before any debts are paid. These costs include court, legal, and executor fees.

Probate takes a long time. It can take up to 2 years. During this time all assets are frozen, and the beneficiaries generally get nothing. However, some states may have provisions for an interim family allowance if needed. You can never justify the delays and headaches associated with probate to a family member, especially in a time of grief.

Probate is nothing more than tedious paperwork caught in an antiquated legal system that desperately needs change. If you own real property in another state, probate is required in each and every state that you own property. This adds greatly to the expense and delay of your probate proceeding.

There are ways to transfer property and avoid probate. Some of these are:

Pay on death accounts can be created using a simple form at your bank. It is an easy way to set up an informal revocable trust. All you do is designate a beneficiary(s) that you want to receive the money in your account when you die.

Most banks do not charge extra for this type of account. You can include any kind of bank account, such as checking, savings, money market, etc. The beneficiary has no right to your account during your life. You can withdraw the money, close the account, or change beneficiary. Be sure to check with your bank before opening this type of account. Some state laws require that you inform the beneficiary first.

Joint tenancy is another way you can avoid probate. This is a way of holding title to property. You can put the real estate or any of your bank accounts into joint tenancy. This is a simple and efficient way for two or more people to hold title to the property. When one person dies, the surviving joint owner(s) automatically gets ownership. This avoids probate but has many pitfalls such as loss of property to judgment creditors and loss of control.

You should check with your state law concerning joint tenancy. A few states restrict joint tenancy to husband and wife only. Remember this: Once you decide to put your property in joint tenancy, you cannot change your mind. The other person becomes the owner of half your property. If the other person gets into financial trouble, you could lose your property.

Life insurance avoids probate by designating a beneficiary to receive cash. A retirement or pension plan also designates a beneficiary and therefore avoids probate.

The best estate planning method by far is a revocable living trust. You avoid probate, keep control of your property during life, and can cancel or change the beneficiary at any time.

If you are confused about what trust is, you’re not alone. You can’t see it or touch it, yet a trust still exists. In legal terminology, a trust is a “legal entity.” It is much like a corporation that you cannot see or touch, but is also a “legal entity”. You can see the people that work for a corporation, the product it produces, the papers it creates, but not the corporation itself.

Trusts have been used for many centuries. They were devised by lawyers as a way of avoiding the property tax laws of the day. In simple terms, a trust is used to hold title to the property. For example, you hold title to your car in your name, your house in your’s, and your wife’s name (also known as joint tenancy or community property).

When you create trust, you no longer hold a title in your own name. The title is held in the name of the trust. For example, the title of your car changes from Jack Johnson to Jack Johnson trustee under trust dated 2/1/21, or your home from Jack and Mary Johnson as community property to Jack and Mary Johnson, trustees under trust dated 2/1/21.

You avoid probate by changing the titles to the property you own into the name of the trust. There is no property in your name, therefore there is no probate. You still have complete control of all your property, and can do with it as you please. This boils down to nothing more than a legal technicality that lets your family avoid probate.

You may have heard the terms, “Revocable Inter Vivos Trust”. “Inter Vivos” means it is created during your lifetime. There is more legal terminology you Will need to know.

Avoid Probate

One of the main benefits of a living trust is that you can avoid probate. When all of your property is transferred into a living trust, it is outside the jurisdiction of the probate court. You no longer own property as an individual; your trust becomes the owner of your property.

When you create a trust you have control of your property because you appoint yourself as the trustee to manage and keep control of your trust property. When you die your trustee duties are transferred to whomever you named as your successor trustee, which is usually your spouse.

Saves Your Family Time And Money

The successor trustee is in charge of transferring your property to other family members, charities, or other beneficiaries. In many cases, this whole process takes only a few weeks. Once all of the property is transferred according to your trust, it ceases to exist. So, as you can see a living trust avoids probate and saves your family time and money. There are other advantages as well.

If the deceased owned real estate in other states, it is usually necessary to have another probate proceeding in that state. This means the family of the deceased Will have to find an attorney in these other states, which can add considerably to the costs of the probate proceedings. With a living trust, the out-of-state property is transferred to the beneficiaries quickly and without probate.

Always consult an attorney when preparing a trust. There are so many changes in the laws from state- to state that small details can be overlooked. Your attorney can provide you with experience, guidance, and you can be assured that your legal documents are prepared properly.

Do-it-yourself legal books are an excellent source of information and can save you money when preparing a simple document like a legal Will. However, preparing a living trust is more complicated and requires many legal documents. Don’t take the chance of making mistakes. Hire an attorney who specializes in legal trusts to guarantee you peace of mind.

A living Will is unlike a legal Will or pour-over Will. It is a document addressed to your doctors. In it, you specify your preferences concerning treatment if you become terminally ill, including your feelings on life support systems.

Your state laws determine what procedure the doctors must follow, and these may not always agree with your last wishes. You can get more information about Living Wills and the many changes in state law at the following websites:

We have discussed what the benefits of a trust are after death. However, there are major advantages during life as well.

For example, let’s say you have a stroke and become incapacitated. Your physical or mental impairment prevents you from managing your affairs, and your spouse or family must apply to the court to have a conservator appointed. Usually, an attorney is hired to represent you. Conservatorship is a legal proceeding like probate; it’s expensive, takes time, and can be a very humiliating affair.

The court requires a strict accounting of all expenses, and they must be submitted to the court for approval. This goes on until you recover or die. Conservatorship does not replace the probate process. When you die, your estate has to be probated and your loved ones would have to go through probate again.

A common misconception is that with a Will, the spouse, children, or relatives can handle day-to-day affairs if a person becomes incompetent. This is not true. If a person is still alive, their Will cannot take effect.

When Conservatorship was first created, it was intended to protect the individual’s property. There are always those unscrupulous individuals who might try to take advantage or take over a person’s property. It was decided that the court would take control and make the final decision for the benefit of the individual.

Despite their good intentions, the courts are often so busy that they cannot take the time to make sound business decisions, especially when selling assets to pay debts. For example, when the real estate market is deflated, it is not the right time to sell real estate. Maybe some other assets can be sold. The same is true with stock portfolios. There is a right time and a wrong time to sell in order to get full value. These and many other decisions that need to be made for an incapacitated person are best made by a trusted relative or friend.

Let’s take an example of what could happen. Jack is a successful real estate investor who owns several properties in joint tenancy with his wife, Sue. One day riding home on his motorcycle, Jack was broadsided by a car that ran a red light. In this split, second everything changed for Jack and Sue. Jack was left incapacitated and in a coma. After one year Jack had not recovered, and his medical expenses were piling up. Sue had to liquidate some of their joint assets by selling a rental property that was in her and Jack’s name.

To her surprise, she found out that since Jack was incapacitated, and could not sign his name, she could not sell the property. Even though Jack had left a Will, it could not take effect while he was still alive.

Sue had to apply to the court for conservatorship, an expensive and tedious process like probate. In essence, Sue had a new partner, the court, who would sign for Jack. Everywhere Sue turned, the court needed to approve everything including bills that were paid and money that was spent. Luckily, Jack came out of the coma and their lives eventually returned to normal.

If Jack had prepared a living trust and Durable Power of Attorney instead of a Will, Sue could have been named as a backup trustee and would have legally been able to handle all of Jack’s affairs. She could have written checks, signed his name on grant deeds to liquidate real estate assets, and avoided conservatorship.

If a minor child’s parents both die and there is no Will, the court Will appoint a guardian for your children. In the event you did appoint a guardian in your Will, the court Will usually go along with your choice during probate, though in some cases they may not, if they determine it’s not in the best interest of the children.

It is important to remember that the guardian Will have custody of the child and the court Will control any money or inheritance for the child. Requests for use of the money for the child must first be approved by the courts. This is a lot like conservatorship.

Let’s say that this child has an extraordinary talent for art. You, as a guardian, would like the young person to develop these talents to his/her fullest potential. You apply to the court for money for private art lessons, and to your surprise the court refuses. It considers art lessons unnecessary and frivolous spending.

Everything that a child needs, including education, art lessons, clothes, etc., must first be approved by the court. A list with all proposed items is usually submitted by an attorney for the costs appraisal. All this is very expensive and is paid through the child’s inheritance.

Again, like conservatorship, your family loses control. The courts make all final decisions in guardianship, which is very expensive and time-consuming. There are many special circumstances not mentioned that can be unpredictable and contribute to depleting a minor’s inheritance.

If a divorced or separated spouse is still alive, the court Will usually name them as guardian, even though this may not have been your last wish. Only with trust Will, you be able to make sure that your minor children are provided for without the court getting involved.

"When she became critically ill, I was helpless. We have been married for 42 years and she always took care of our financial matters. I knew absolutely nothing about our financial status. It took my daughter and I ten days figuring out what bills had to be paid and how to pay them, finding out if Mother had disability coverage through her job, locating insurance policies, and dealing with Medicare. After two weeks, I was emotionally drained. Had I paid all the bills? Had I taken care of all of the disability coverage? Where are there any other assets we neglected to find"?

This scenario is not uncommon, just ask any life insurance agent. Most people desperately need help when the death of a spouse takes place. This chapter is intended to help those faced with the death of a spouse or loved one.

The emotional trauma of losing a loved one is not easy, but knowing what needs to be done, and where things are, Will saves you many hours of emotional stress. The first thing I must emphasize is that you must get organized before a crisis occurs. Personal and financial papers and information should be organized so that you have easy access to them.

Let other people help me

Make a list of a team of people that you can depend on to help in case of a crisis, such as your daughter, son, friend, attorney, minister, or insurance agent. Be sure that you have the phone numbers and addresses of your team of helpers.

Write down a list of phone numbers and addresses of important financial and personal companies such as insurance companies, banks, stockbrokers, and hospitals. Keep accurate records concerning any real estate investments, or your residence. Be sure to have access to all the receipts for any home improvements you have done over the years. Without these records, you may be paying more taxes than you should when you sell your property.

Many people want to sell their homes after the death of a spouse. Don’t be too hasty. Be sure it is the correct decision for you or your loved one. In a deflated real estate market you can lose a substantial amount of money. You may want to consider renting your property until the market changes; A good property manager can help you with this. He or she Will handle everything from advertising the property, rental agreements, and making sure you receive the rent on time.

To make record keeping easier for you, make a checklist of everything that should be done after a death of a loved one. This Will provide you with easy access to important information at a time when you may need it the most. Store this list in a safe place.

It can save your family thousands of dollars and many hours of emotional turmoil.